Pragmatic Venture Blueprint

Card 5 of 18

Validate your assumptions

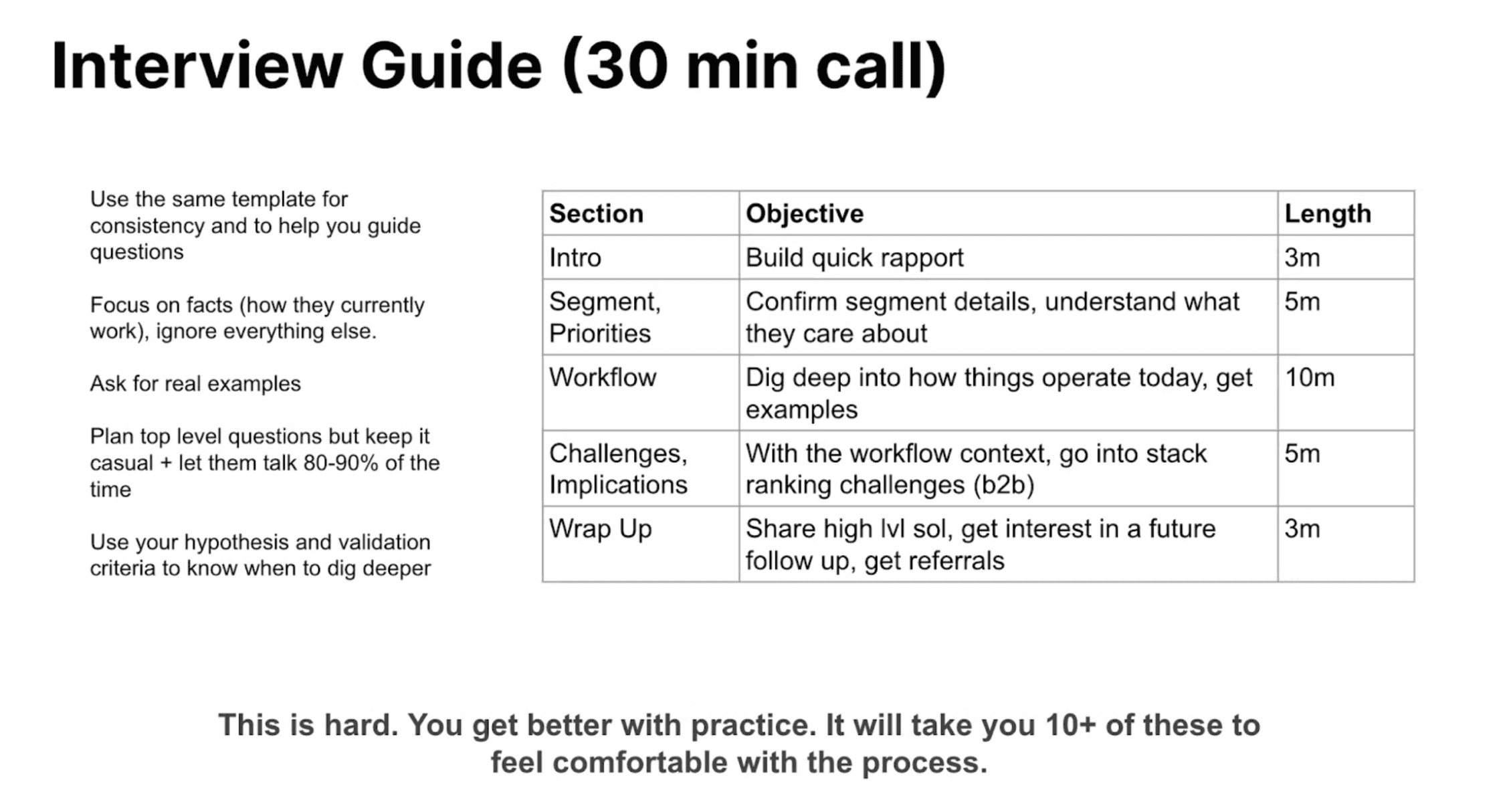

When doing discovery calls, the goal is to gather objectively useful data. Structure your calls by starting with broad, easy questions and gradually moving to more specific ones to gain context and avoid bias. We prioritize collecting objective information rather than steering the conversation, aiming to uncover the truth. Using a well structured interview guide, you can ensure consistency and clarity so that it is easier for you to compare results from different discovery calls.

Category

Demand Validation (2-2)

Author

Jeremy Vo

How do I run a discovery call?

Objective: Collect data that is objectively useful.

Strategy: The flow of the calls should be structured in a high level to low level manner. Typically, it is best to start off a call by getting a prospect to open up about topics that are easy to answer, and then start to drill in deeper as new information is surfaced. This high level to low level manner allows you to also receive context on why an issue is an issue.

For example: if I asked off the bat: “What is the hardest part of Financial Modelling?” you would be jumping in too quickly into a small piece of their workflow + you might have biased the call towards that problem statement. Now the prospect cannot think of anything other than Financial Modelling. A better way to approach this would have been to ask about the persona’s responsibilities, priorities, how things operate today, what processes they have, what tools they use… and then once you have enough info on those items, ask about the Financial Modelling. This line of questioning then gives you context to how important it is across a myriad of other items they might care about.

Tactics: Craft a interview guide so that you are consistent with your line of questioning across multiple prospects, but also clear in terms of what questions you will ask and when you will ask them. Timing of the questions is just as important as what you ask.

How to structure an interview guide:

Typically, we want to start from the highest level to the lowest level —> this allows us to capture context and then work our way to the problem articulations

Further, we mostly care about fact collection (i.e. things that happen today or have happened in the past, rather than focusing on opinions - things that might happen in the future) = we want to typically save opinions for the end to not bias the conversation

When start off, it’s usually best to start off with easier questions that get the prospect in the groove of giving information. if you start off with super tough questions, they will get clammy and be awkward for the rest of the call.

Start off with questions like: “how big is your team? how is it structured? how many customers do you have?” = things that are easy to answer

Thought process on questions:

if you look at the above diagram on the flow of an interview guide, you will see a few sections on the left of the chart.

There is a reason for why they are laid out in this order: we want to collect information that initially allows us to compare this prospect to other prospects we speak to but also gain trust.

Segment/Priorities is to confirm the segment details, get them speaking, and try and figure out where their head is at in the present and the near future.

Workflow is to capture context into what is happening today such as process, tools, jobs to be done, etc = we want to spend a lot of time here (LeapMotiv spends at least 30-40% of a call on this) in order to best understand what happens in our prospect’s life at work.

Challenges: once you have a purview into the workflow, it gives you right of way to then ask what challenges they face. you can use this generally as in “what is the hardest part of your job?” or you can go more targeted from something unearthed in the workflow as in “what is the hardest part about X?” —> try to also quantify and understand the implications of solving that problem as well.

Wrap Up: this is where you can share some high level tidbit on your venture idea to see if they are interested in continuing the convo. the objective here is to generate interest, not to sell them right away. we want follow up calls and consecutive meetings.

TIP #1: for the intro, never talk about too much about what what solution you are building. Simply talk about the general space you are trying to solve a problem in and mention that you will give them more info on it at the end of the call. by being slightly vague upfront, you won’t bias the convo one way.

TIP #2: in workflow section, starting with binary questions such as “do you do X” can help suss out the line of questions. If they don’t have X, then you might move onto a different subject right away. If they do have X, then you can drill in deeper.

Considerations

Timing of questions is just as important as what question you ask. Learning when to move on and when to dig in deeper is a trained skill.

Budget extra time so that you can double click into areas when there are interesting points or when you want to gain a higher fidelity of information. Do not read an interview guide verbatim, otherwise you will sound like a robot.

If an interviewee is going completely off the rails, do not be afraid to politely interrupt them and rephrase the question so that they are not wasting time on things that may not be relevant for you.

Beware of other forms of bias outside of using leading questions. For example there are 2 that come to mind right away:

Liking Bias: if you’re talking to a friend, they might like you and not want to hurt your feelings. therefore, it’s usually better to speak to strangers.

False Consensus: if someone seems like a subject matter in a topic, but are not able to produce examples or depth on a particular issue, then they might be speaking on behalf of a population without actually being in that population themselves. these people just want to appear smart but are very dangerous for us. you can generally suss them out by asking for real life examples.

How do I know if there's a good fit?

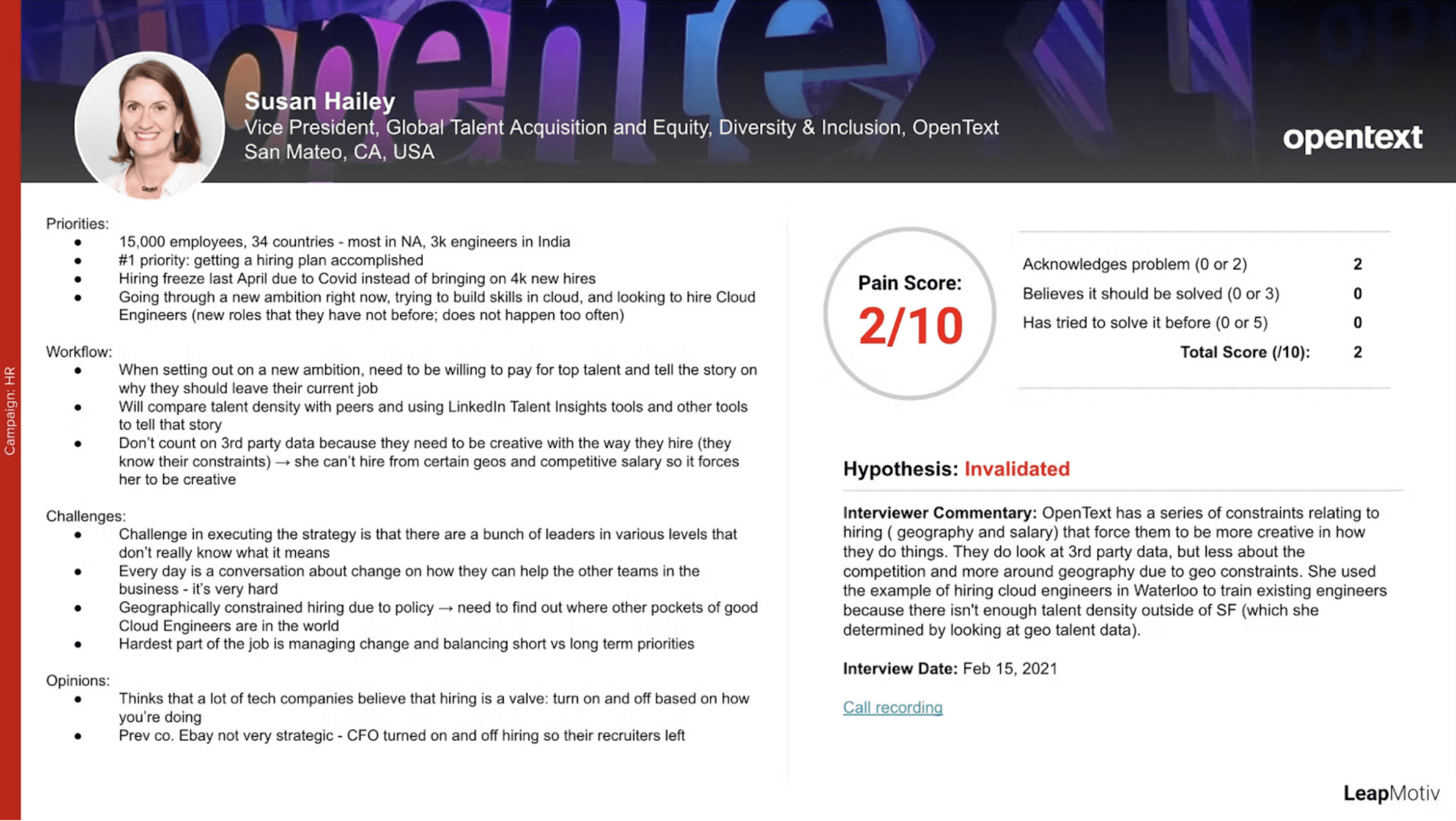

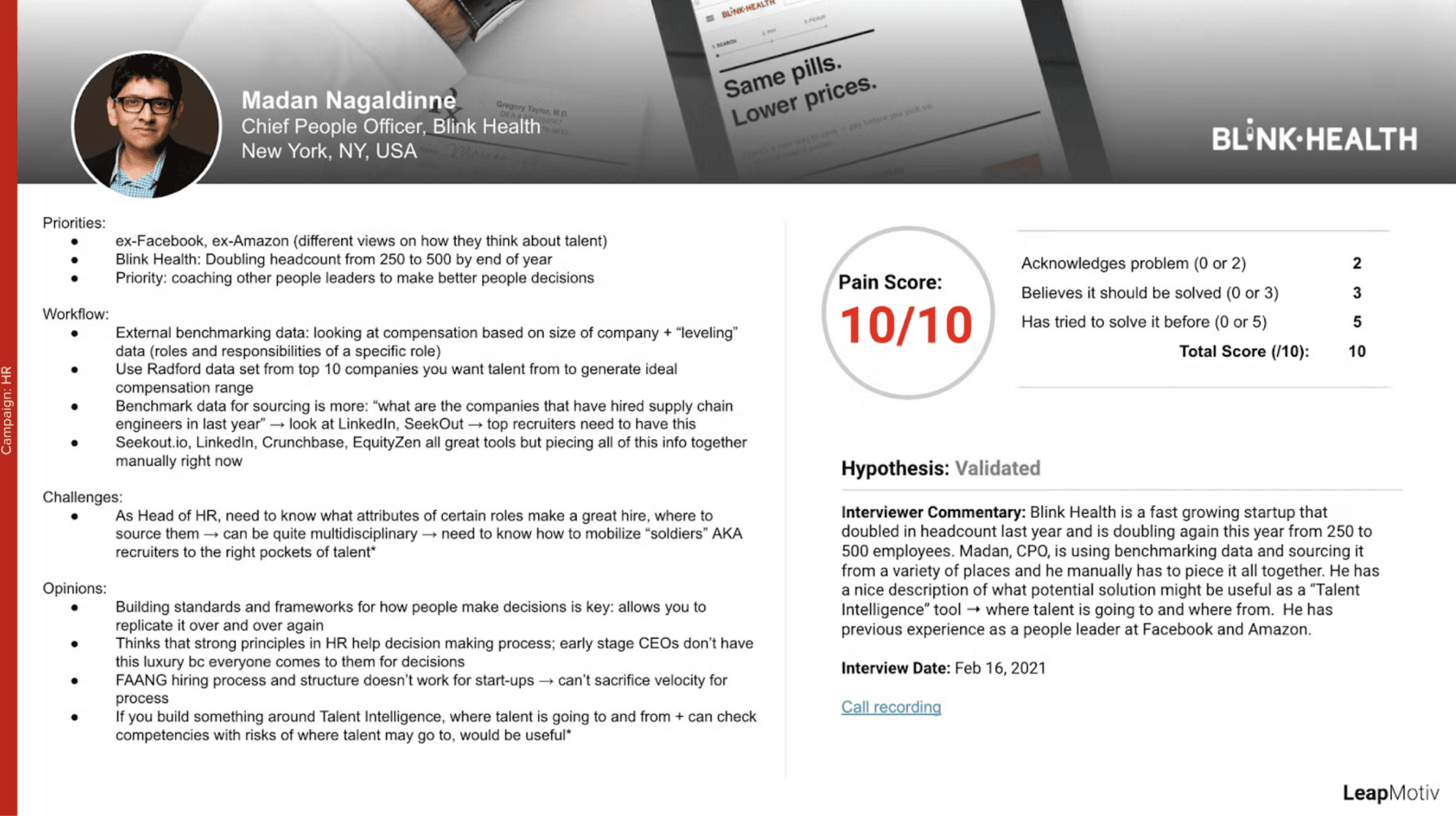

One vehicle we have found extremely useful to present information that we learn on a call is to transpose our learnings onto a Call Summary Chart. These charts allow us to display useful information in an easy-to-read manner for others to digest as well. Particularly, we are breaking down the learnings into facts (priorities, workflow, challenges) vs opinions.

Pain Scoring

It’s often hard to compare one call to another but with Pain Scoring, it gives you an objective measure to see who you should focus more of your time on.

In B2B, we often like to use 3 major validation criteria for how urgent a problem is: 1) Customer acknowledges the problem, 2) Customer believes it should be solved, and 3) Customer has tried to solve the problem before.

We also attribute more weight on the pain score to attributes where it is likelier to produce a good customer (i.e. criteria 3 is a much better signal than criteria 1, and therefore it should be weighted higher; in this case, 5 points instead of 2).

As you can infer, #3 has much more weight than #1. A prospect might acknowledge the problem but if they have not done anything to solve it before… is it really a problem? Whereas if they believe it should be solved and has already deployed resources such as time/money/energy into solving it, it is a clear indicator that it is a priority to solve for.

Below are is an example summary chart of a strong problem worth solving at 10/10 pain score.

Madan in this case is has a 10/10 pain score because he acknowledges the problem, believes it should be solved AND has tried to solve it before.

We believe the scores for the validation criteria should also be binary: full points or no points.

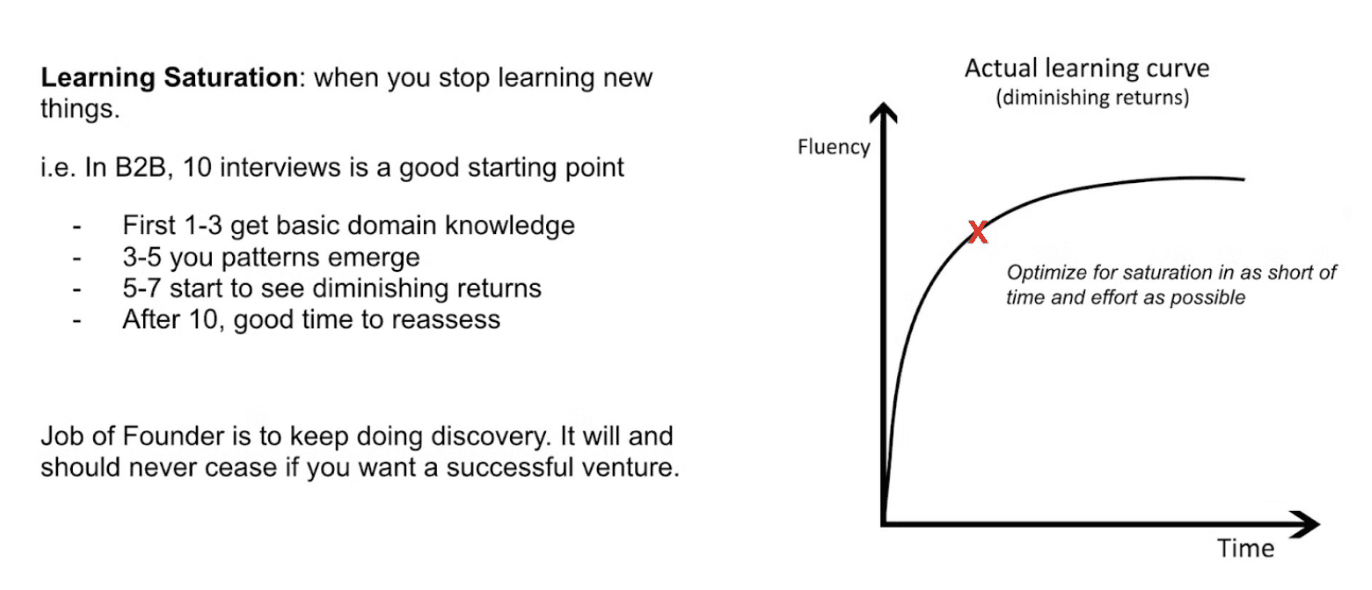

How many meetings is enough?

Short answer is: when you stop learning new things.

In B2B, anecdotally, for every 10 calls or so, you should be able to reach a good understanding of the segment and problem you’re actively working on. We often see ventures shift 2-3x before landing on one that they want to pursue more concretely.

Considerations

When interviewing prospects, try to keep in mind snippets that can directly correlate to the validation criteria. Being able to directly reference a quote from a call that helps you build your case is extremely powerful both internally and externally.

A common trap is to manufacture the pain score based on what you believe. However, if the prospect does not give you a specific answer that maps out to a pain score attribute, don’t make it up.

The pain score validation criteria are malleable! There is no perfect framework for it. We have seen this general one work great for B2B Technology companies, but you may choose to update the validation criteria to something that works better in your favour.

Call summary charts do not need to look pretty. The purpose is simply to keep yourself organized - use whatever format you want, be it Notion, Google Slides, Spreadsheets, etc.

Additional resources